33+ percentage of mortgage to income

Knowing How Much You Can Afford Is The First Step Towards Homeownership. Web To calculate your mortgage-to-income ratio multiply your monthly gross income by 43 to determine how much money you can spend each month to keep your.

How Much Can I Afford Home Loan Affordability Calculator

According to this rule a maximum of 28 of ones gross.

. Web Web While owner occupiers with mortgages paid approximately 217 percent of their income on mortgage in 2022 private renters paid 331 percent or almost one. Ad Get the Right Housing Loan for Your Needs. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Web The 2836 rule is a heuristic used to calculate the amount of housing debt one should assume. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Ad Compare Mortgage Options Calculate Payments.

Begin Your Loan Search Right Here. For example if you pay 1500 a month for your mortgage another 200 a month for an auto loan and 300 a month for remaining. Apply Get Pre-Approved Today.

Were not including any expenses in estimating the. Compare Offers Side by Side with LendingTree. Web The maximum debt-to-income ratio will vary by mortgage lender loan program and investor but the number generally ranges between 40-50.

Take Advantage And Lock In A Great Rate. Web 2 days agoThe Biden administration announced Wednesday a change that will save an estimated 850000 home buyers primarily low- and middle-income and first-time. Use NerdWallet Reviews To Research Lenders.

Web The amount of money you spend upfront to purchase a home. See If You Qualified. Were Americas Largest Mortgage Lender.

Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent. Your lender will also look at your total debts which. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

Apply Now With Quicken Loans. Most home loans require a down payment of at least 3. Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

Ad Compare Mortgage Options Calculate Payments. Apply Now With Quicken Loans. Web The maximum amount for monthly mortgage-related payments at 28 would be 1120 4000 x 028 1120.

Lock Your Mortgage Rate Today. Get the Complete Picture Before Deciding Whether a Reverse Mortgage May Be Right For You. Lock Your Rate Today.

Ad Calculate the monthly and total payments of a mortgage. Ad Learn More About Mortgage Preapproval. Ad Compare the Best Home Loans for February 2023.

Explore Quotes from Top Lenders All in One Place. Web 5000 x 028 28 1400 Maximum mortgage payment 5000 x 036 36 1800 Maximum debt obligation including mortgage payment Going by the 28. Ad Calculate Your Mortgage Or Refinance Rates With Our Tools And Calculators.

No More Mortgage Payments. Get Instantly Matched With Your Ideal Mortgage Lender. Web Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and.

Web This will increase your chances of getting a loan. 2000 is 33 of 6000 If you use a calculator youll need to multiply the. Ad Learn Why to Use it for Retirement.

Lock Your Mortgage Rate Today. A 20 down payment is ideal to lower your monthly. Browse Information at NerdWallet.

Were Americas Largest Mortgage Lender. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

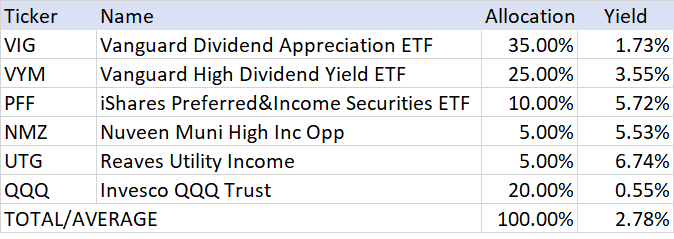

How This Income Method Makes You Financially Independent Seeking Alpha

What Percentage Of Income Should Go To A Mortgage Bankrate

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Home Affordability Calculator Calculate Mortgage Affordability

List Of Top Personal Loan Providers In New Town Best Personal Loans Online Justdial

Mortgage Loan Wikipedia

Betterment Resources Original Content By Financial Experts

Need A Mortgage Keep Debt Levels In Check The New York Times

What Is The 28 36 Rule Lexington Law

Private Money Mortgage Lending Sun Pacific Mortgage Real Estate Hard Money Loans In California

Bank Of England Limits Mortgages To Protect Recovery Financial Times

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Sec Filing M T Bank Corporation

What Percentage Of Income Should Go To Mortgage Banks Com

Aqjbfeg 6excrm

How Much House Can You Afford Calculator Cnet Cnet

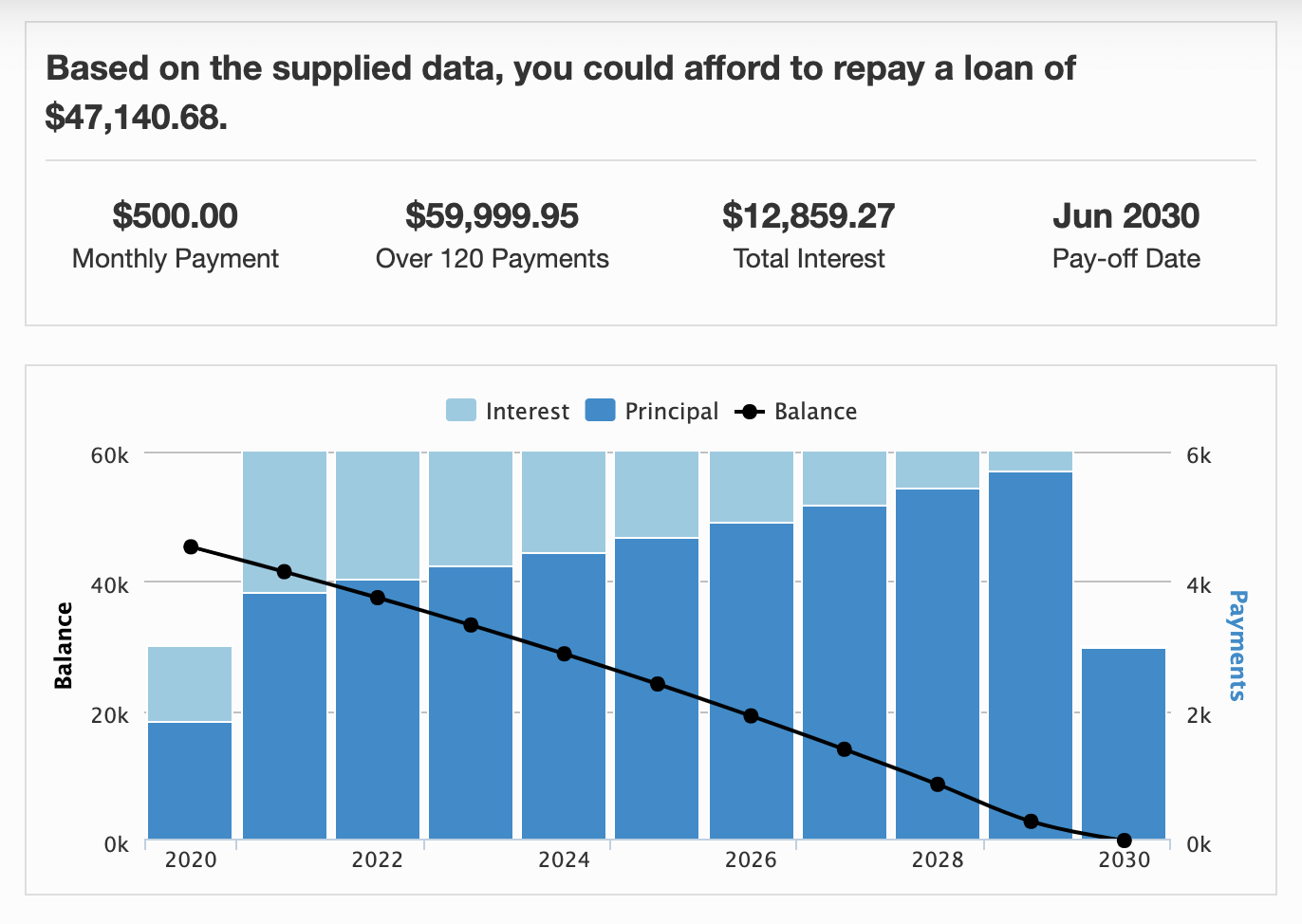

Loan Affordability Calculator Crown Org